20 New Info For Selecting AI Stock Predictions Analysis Sites

20 New Info For Selecting AI Stock Predictions Analysis Sites

Blog Article

Top 10 Ways To Evaluate The Integration And Compatibility Of Ai-Based Stock Predicting/Analyzing Trading Platforms

Integrity and compatibility are two of the primary factors to consider when evaluating AI stock forecasting/analyzing trading platforms. A platform that seamlessly integrates with the existing processes, tools and systems of your company can increase productivity and efficiency. Here are the top 10 tips to assess compatibility and integration.

1. Check Brokerage Integration

Brokers that are supported - Ensure that the platform is integrated with your brokerage or trading account.

Trade execution: Check if the platform allows direct trade execution using the broker integrated.

Account synchronization: Verify that the platform can update in real-time balances and positions of your account as well as transaction histories.

2. Examine API Accessibility

API access is crucial Developers can make use of an API, or Application Programming Interface (API) to create their own software and automate processes.

API documentation - Verify that the API's example and usage cases are well-documented.

Rate Limits: Examine the API's rate limits to confirm that they are appropriate and can accommodate your expected use.

3. Check the integrity of a third-party tool.

Popular tools Check to see if there are any integrations between the platform as well as tools like Google Sheets, Excel, or trading robots.

Export and import of data. Make sure the tool can export/import data quickly from/to other tools.

Extensions/Plugins: Check if the platform is compatible with plugins or extensions for additional functionality.

4. Test Compatibility Operating Systems

Desktop compatibility is essential. Check that your system works on the operating system you like (Windows MacOS Linux).

Mobile compatibility - Look to see if a platform has a mobile app that is compatible with iOS as well as Android.

Web-based Access: Determine if you can access the platform via a browser to increase flexibility.

5. Analyze Data Integration Capabilities

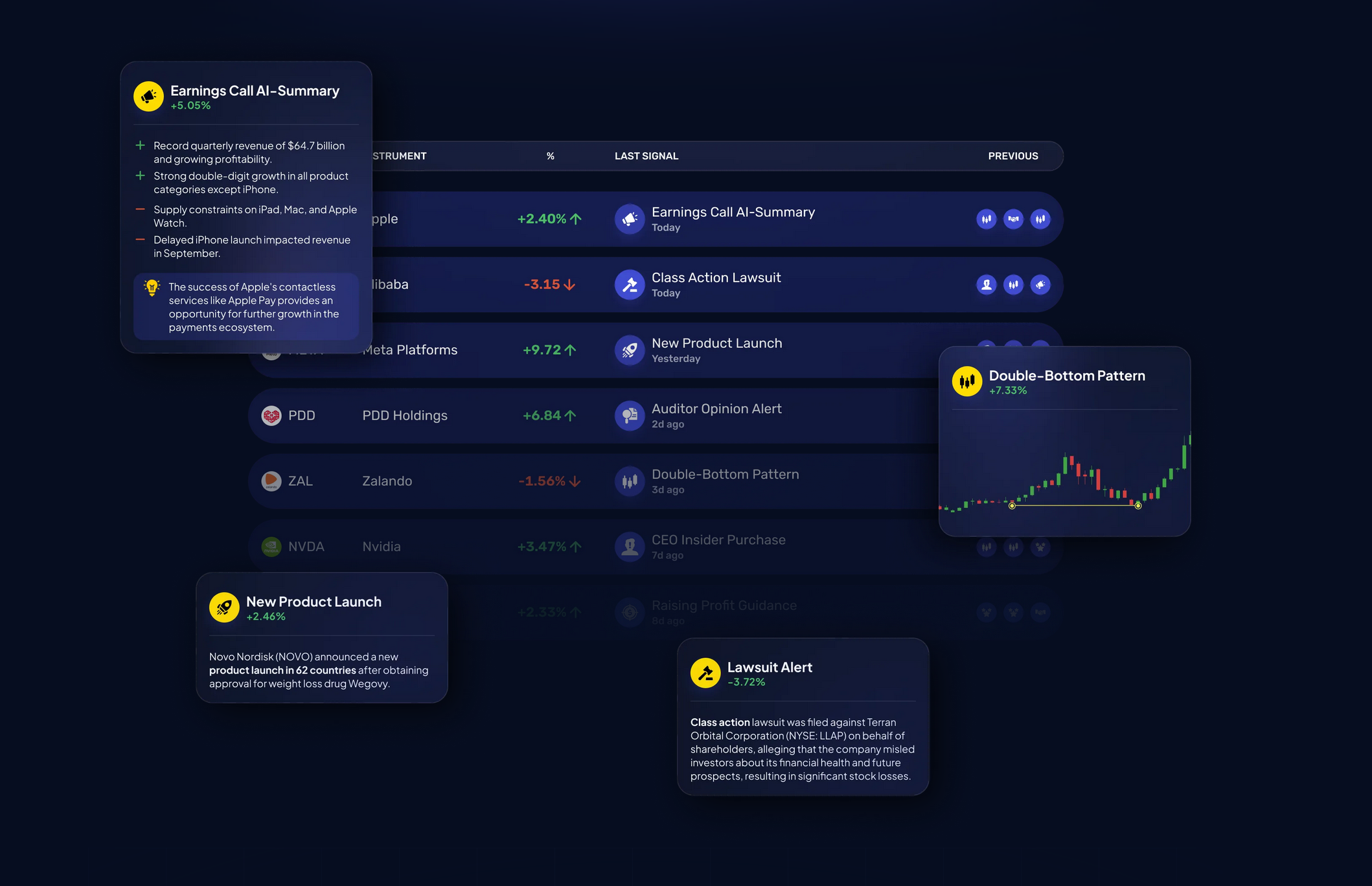

Data sources - Make sure that the platform is integrated with different sources of data (e.g. news feeds, market data, sentiment on social media).

Real-time data streams: Ensure that the platform can integrate live data streams to provide the most up-to-date analysis.

Historical data import - Verify that the platform allows you to add historical data to your backtesting or analytical software.

6. Evaluation of cloud and on-premise compatibility

Cloud-based platforms: the platform must be available from anywhere with internet access.

On-premises deployment: Find out if the platform you're using supports on-premises deployment.

Find out if the platform offers an option to mix both on premises and cloud capabilities.

7. Check for Cross Platform Syncronization

Device sync. The platform should connect settings and data to all devices, including desktop, mobile and tablet.

Real-time updates: See if the changes you make on one device immediately show up on the other devices.

Offline Access: Examine to determine if there are any limitations on the functionality of the platform or data access when it's offline.

8. Assessment of the degree of compatibility with trading strategies

Algorithmic trading: Make sure that the trading platform you choose allows automated or algorithmic trading strategies.

Custom indicators - Make sure to check if the platform permits the use of customized scripts and technical indicators.

Backtesting strategy Check to see if the trading platform supports backtesting with historical data.

9. Examine Security and Compliance

Data encryption: Verify that the platform uses encryption to safeguard data in transit and while at rest.

Authentication Check if the platform is secure in terms for authentication (e.g. Two-factor authentication).

Regulatory compliance : Verify if the platform is in compliance with relevant regulations.

10. Test Scalability, Performance, and Efficiency

Scalability: Ensure that the platform is able to handle the increasing amount of data and users as your needs grow.

Performance under load: Determine whether the platform continues to be flexible during market conditions with high volatility.

Resource usage: Find out if your platform uses its system resources (CPU/memory and bandwidth) efficiently.

Bonus Tips

Customer feedback: Read user reviews and testimonials to evaluate the capabilities to integrate the platform.

Trial period: Try a free trial or demo to test the integration of the platform with your existing tools and workflows.

Customer Support: The platform should offer robust support when it comes to integration issues.

By following these tips, you can effectively assess the integration and compatibility of AI stock predicting/analyzing trading platforms in order to ensure they are compatible with your existing systems, and improve the efficiency of your trading. Have a look at the top read this for ai stock for blog examples including ai investment app, investing ai, options ai, ai stock market, ai investment app, ai stocks, ai for trading, ai investment app, ai trading tools, ai for investment and more.

Top 10 Tips On How To Assess The Speed And Latency Ai Analysis And Stock Prediction Platform

The speed and latency of a system is crucial when it comes to considering AI software for stock prediction or analyzing trading platforms. This is especially important for high-frequency traders, algorithmic traders, as well as active traders. Milliseconds delay could have a negative impact on the execution of trades. Here are ten of the most effective methods to gauge the speed and the latency of the platforms.

1. Real-time data feeds to be analyzed

Speed of data delivery: Make sure the platform is able to deliver real-time information with minimal delay (e.g. sub-millisecond latency).

Verify the source's proximity to the most important exchanges.

Data compression: Check if the platform uses effective techniques for data compression to speed up the delivery of data.

2. Speed of execution test for trades

Order processing time: Measure how fast the platform process and executes trades when you have submitted an order.

Direct Market Access (DMA) Make sure that your platform supports DMA. This allows orders to go directly to the exchange, without the necessity of intermediaries.

Check for detailed execution reporting that includes timestamps as well as confirmations of the order.

3. Examine the Receptivity of Platforms

User interface (UI speed) Find out how fast the system responds to inputs for example, clicking buttons or loading charts.

Chart updates - Verify that the charts are updated in real time and without lag.

Performance of mobile app: If you use mobile apps on your phone, be sure that it runs as fast as its desktop counterpart.

4. Look for infrastructure that is not low-latency.

Location of servers The platform is running a low-latency server located near financial hubs and exchanges.

Co-location Services: Verify if the platform allows co-location. This allows you to save your trading algorithms on servers located near the Exchange.

High-speed networks: Verify if the platform uses high-speed fiber-optic networks or other low-latency technologies.

5. Check the backtesting speed and simulation speed.

Test the platform's capability to process and analyze the historical data.

Simulation latency: Make sure the platform is able to simulate trades in real-time with no any noticeable delay.

Parallel processing: Check if the platform uses the concept of distributed computing or parallel processing to speed up complicated calculations.

6. Calculate API Latency

API responses: Find out the speed at which APIs respond to queries (e.g. retrieving information from the platform, or placing orders).

Rate limits: Check whether API has reasonable rate limits in order to avoid delays during high-frequency trades.

WebSockets support: Ensure that the platform utilizes WebSockets protocols to provide low-latency streaming of data.

7. Test Platform Stability Under load

High-volume trades to test the platform's flexibility and stability, try simulated high-volume scenarios.

Market volatility: Test out the platform during times that are high in volatility to test whether it can manage rapid price adjustments.

Test your strategy for stress: Find out whether the platform allows you to test your strategy under extreme circumstances.

8. Evaluate network and connectivity

Internet speed requirements: Ensure your connection is up to the recommended speed of your platform.

Redundant connection: Check to determine if there are any redundant connections in the network.

VPN latency: When using the VPN platform, make sure to determine if the latency is significant and also if there are alternative options.

9. Look for features to speed up your performance.

Pre-trade Analytics: Ensure that the platform has pre-trade analytics to improve the speed of execution, order routing and many other aspects.

Smart order routing (SOR) is also referred to as smart order routing is a method to determine the most speedy and cost effective execution venues.

Monitoring latency: Determine that the platform offers tools to monitor and analyze latency in real-time.

Review User Feedback Benchmarks

User reviews: Study feedback from users to evaluate the platform's speed and latency performance.

Third-party Benchmarks: Discover independent benchmarks that evaluate the performance of a platform against its competitors.

Case studies: Check whether the platform offers cases studies or testimonials that highlight the platform's low-latency capabilities.

Bonus Tips:

Trial period: Take a an unpaid test or demo of the platform to see how it performs in real situations.

Customer support - Check if there is support available to address issues related to latency, optimization or any other problems.

Hardware requirements: Determine if the platform requires specific hardware to ensure the best performance.

These guidelines will assist you to assess the speed and latency of AI stock-predicting/analyzing trading platforms. So, you'll be able to select a platform that meets your needs while minimizing delay. Trading platforms with low latency are vital for traders who use high-frequency algorithms. Small delays can negatively impact their profits. Follow the most popular home page on ai tools for trading for more examples including ai copyright signals, stock predictor, ai options, how to use ai for copyright trading, ai stock price prediction, ai options trading, best ai stocks, ai software stocks, ai tools for trading, ai software stocks and more.